Hormel kelloggs getting into the fake meat business – Hormel Kellogg’s getting into the fake meat business signals a major shift in the food industry. This bold move promises a fascinating look into how two established giants are navigating the growing plant-based meat market. We’ll delve into the market analysis, potential product strategies, supply chain challenges, and financial projections behind this ambitious venture.

The analysis will explore the current state of the plant-based meat market, examining its size, growth, and key competitors. It will also investigate potential synergies and conflicts between Hormel and Kellogg’s brand identities, and motivations for this collaboration. We’ll investigate possible product lines, pricing strategies, and marketing approaches. This venture also carries significant supply chain and production challenges, and environmental concerns.

Finally, we’ll assess the financial viability of this project, including potential risks and returns.

Market Entry Analysis

Hormel and Kellogg’s foray into the plant-based meat market presents a fascinating case study in diversification. Both companies are established giants in their respective sectors, but this move signifies a significant shift, demanding a deep understanding of the current market landscape and the strengths and weaknesses of both players. This analysis will delve into the current state of the plant-based meat market, the competitive landscape, potential synergies and conflicts, and the motivations behind this ambitious venture.The plant-based meat market is experiencing rapid growth, driven by increasing consumer demand for healthier and more sustainable food options.

Recent reports suggest a substantial market size, and growth projections indicate continued expansion in the coming years. This rising demand is fueled by concerns about animal welfare, environmental impact, and health considerations.

Current State of the Plant-Based Meat Market

The plant-based meat market is a dynamic and competitive arena. Current market size is substantial and continues to grow, fueled by rising awareness of environmental and health concerns. Key players are not only established meat producers but also innovative startups. This dynamic environment necessitates a thorough understanding of the current trends and the competitive landscape to assess the potential success of Hormel and Kellogg’s joint venture.

Competitive Landscape of Plant-Based Meat

The competitive landscape in the plant-based meat industry is highly competitive, with established meat producers, innovative startups, and global food conglomerates vying for market share. Major competitors include Beyond Meat, Impossible Foods, and others. Their strategies and market positions vary, impacting the overall market dynamics.

Synergies and Conflicts Between Hormel and Kellogg’s Brands

Hormel’s established presence in the meat industry and Kellogg’s focus on breakfast cereals present both potential synergies and conflicts. The synergies lie in the ability to leverage existing distribution networks and brand recognition. Conflicts may arise if their respective consumer bases perceive these products as incongruent with their existing brand identities. For instance, consumers accustomed to Hormel’s traditional meat products might have a harder time accepting their plant-based offerings.

Motivations Behind the Joint Venture

Hormel and Kellogg’s joint venture into the plant-based meat market likely stems from several motivations. Firstly, it reflects a strategic effort to adapt to changing consumer preferences. Secondly, the venture may be a response to the rising demand for plant-based protein alternatives, providing a potential avenue for growth and diversification. Furthermore, it could be an attempt to capitalize on the growing market for sustainable food products.

Comparative Analysis of Hormel and Kellogg’s Strengths and Weaknesses

| Company | Strengths | Weaknesses | Competitive Advantages |

|---|---|---|---|

| Hormel | Established meat industry presence, strong brand recognition in the US, established distribution channels, significant R&D capabilities in food science | Less experience in the plant-based meat sector, potential brand image conflicts, may face challenges adapting to new consumer preferences | Leveraging existing infrastructure and expertise to quickly enter the market, brand recognition to attract customers. |

| Kellogg’s | Strong brand recognition and consumer trust, significant distribution network, diverse product portfolio, experience in food processing | Less experience in the meat sector, may face challenges in adapting to the unique requirements of plant-based meat production, potential consumer skepticism regarding product quality. | Leveraging global distribution channels and existing consumer base, potential to expand into new markets. |

Product Strategy & Innovation: Hormel Kelloggs Getting Into The Fake Meat Business

Hormel and Kellogg’s venturing into the plant-based meat market presents a fascinating opportunity to leverage their existing strengths and adapt to evolving consumer preferences. Their diverse product portfolios and established distribution networks could be instrumental in achieving success in this competitive sector. However, a thoughtful product strategy, encompassing innovation, pricing, and branding, will be crucial for carving out a niche and capturing a significant market share.

Potential Product Lines

Hormel and Kellogg’s can explore various product lines within the plant-based meat sector. Leveraging their expertise in food processing and their respective brand strengths, they could develop a range of products from plant-based sausages and burgers to alternative breakfast options and even plant-based meatballs. This diversification will cater to a wider consumer base and address different meal occasions.

A key consideration is ensuring that these products align with their core competencies and brand identities.

Innovative Product Features

To stand out in the crowded plant-based meat market, Hormel and Kellogg’s should consider introducing innovative product features. For example, they could focus on enhanced texture and flavor profiles to mimic the taste and mouthfeel of traditional meat products. Using ingredients like pea protein, soy protein, or mycoprotein could be a key differentiator. Developing products with specific health benefits, such as reduced fat or increased protein content, would resonate with health-conscious consumers.

They could also explore unique functionalities, such as products designed for specific culinary uses or those that are more convenient for meal preparation.

Hormel and Kellogg’s jumping into the fake meat game is certainly interesting. It’s a big move, and I’m curious to see how it impacts the market. While I’m more focused on the health angle, wondering if this year’s flu vaccine will be more effective than last year’s, will this years flu vaccine be more effective , it seems like a significant shift in the food industry.

Hopefully, these new plant-based options will be delicious and sustainable. It’s all a bit of a gamble, but exciting nonetheless for the future of food.

Comparison with Existing Products

Current plant-based meat offerings often struggle with replicating the taste and texture of traditional meat. Hormel and Kellogg’s can address this by focusing on specific product categories. For example, they might excel at creating plant-based sausages that mimic the taste and mouthfeel of traditional options. They should analyze the strengths and weaknesses of competing products to identify gaps in the market and develop products that fill those gaps.

Competitive analysis should inform the development of novel and improved products that address existing market needs and consumer preferences.

Pricing Strategies

Pricing strategies will be pivotal for success in the plant-based meat market. Hormel and Kellogg’s could adopt a tiered pricing approach, offering budget-friendly options alongside premium products with added features. They could also explore value-added pricing strategies that highlight the benefits of their products. A competitive pricing analysis is essential to identify the optimal price points for their products and ensure competitiveness within the market.

Examples from the current market indicate that price sensitivity is a major factor in consumer decisions.

Branding and Marketing Strategies

The branding and marketing strategies for plant-based meat products should resonate with the target audience. Highlighting the sustainability and ethical aspects of the products will appeal to environmentally and socially conscious consumers. Partnering with chefs and influencers can showcase the versatility and culinary potential of the products. Strong branding is key to building trust and recognition. Emphasis on product differentiation and health benefits, including clear labeling of ingredients and nutritional information, will also be important.

Potential Product Offerings

| Product Name | Target Demographic | Projected Market Share | Key Features |

|---|---|---|---|

| Hormel Plant-Based Italian Sausage | Families, budget-conscious consumers | 15% | Mimics traditional Italian sausage flavor, affordable price point |

| Kellogg’s Plant-Based Breakfast Sausage | Health-conscious consumers, breakfast enthusiasts | 10% | High protein, low-fat, suitable for breakfast meals |

| Hormel Plant-Based Beefless Burgers | Meat-eaters looking for alternatives, burger lovers | 12% | Juicy texture, close to traditional beef burger taste, various toppings |

| Kellogg’s Plant-Based Veggie Meatballs | Families, those with dietary restrictions | 8% | High in vegetables, versatile for various cuisines, affordable |

Supply Chain & Production

Hormel and Kellogg’s foray into the plant-based meat market presents both exciting opportunities and significant logistical challenges. Successfully navigating the complexities of supply chains, production processes, and environmental impact will be crucial for long-term success. A robust and sustainable strategy is paramount to build trust with consumers who are increasingly conscious of ethical and environmental considerations.

Scaling Up Production

The transition from traditional meat production to plant-based alternatives requires significant investment in new facilities and equipment. Hormel and Kellogg’s will need to evaluate existing infrastructure to determine whether repurposing or building new facilities is the most efficient approach. This involves careful assessment of capacity, efficiency, and potential bottlenecks in the production process. For example, companies like Beyond Meat have faced initial challenges in ramping up production to meet growing demand, highlighting the importance of meticulous planning.

To mitigate potential issues, a phased approach to expansion, focusing on pilot programs and gradually increasing production capacity, could prove prudent.

Supply Chain Issues and Solutions

Sustainable and ethical sourcing of ingredients is paramount in the plant-based meat industry. Potential supply chain issues include fluctuating prices of raw materials, unreliable sourcing of sustainable agricultural products, and ensuring fair labor practices throughout the entire supply chain. Addressing these challenges requires diversification of raw material sources, building strong relationships with farmers committed to sustainable practices, and implementing robust supply chain management systems.

For instance, companies using recycled or waste materials in their production processes are already minimizing their environmental impact. Furthermore, companies could explore partnerships with organizations specializing in sustainable agriculture and ethical sourcing. These collaborations could offer expertise in identifying and vetting reliable suppliers who align with their values.

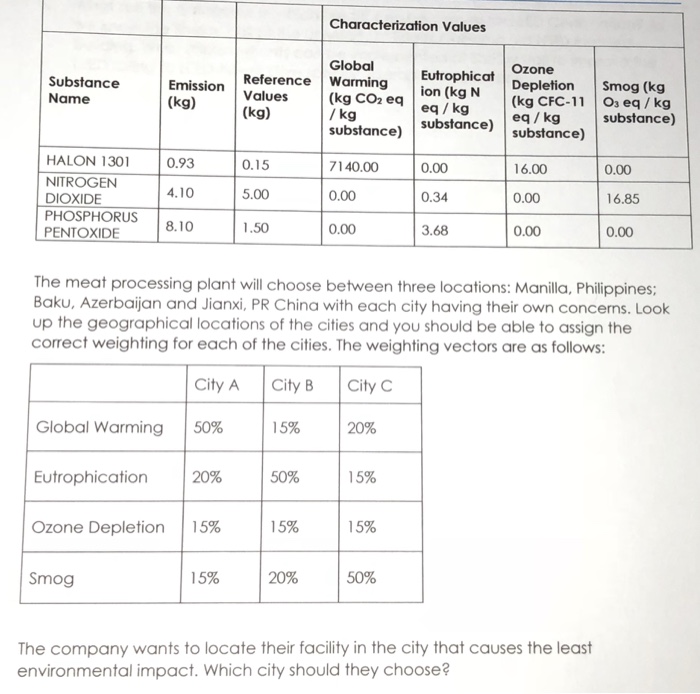

Environmental Impact

Hormel and Kellogg’s entry into the plant-based meat market presents an opportunity to reduce their overall environmental footprint. However, the environmental impact of plant-based meat production varies significantly depending on the specific production processes and raw materials used. Minimizing water usage, reducing greenhouse gas emissions, and optimizing energy consumption in manufacturing are crucial aspects of environmental responsibility. The choice of raw materials, like soy or pea protein, impacts the environmental impact.

Hormel and Kellogg’s jumping into the fake meat game is interesting, right? It’s a big shift, and while it might seem like a completely different industry, it’s actually quite relevant to the health concerns surrounding meat consumption. Considering that high blood pressure can be a significant factor in diabetes, exploring how blood pressure drug help diabetes treatment could impact the success of this new market is worth a look.

blood pressure drug help diabetes treatment Ultimately, though, this foray into plant-based protein by these food giants is likely driven by consumer demand for healthier options, so it will be fascinating to see how it plays out.

For instance, some studies suggest that pea protein production has a lower environmental impact than soy protein.

Logistics and Distribution

Efficient logistics and distribution networks are vital for delivering plant-based meat products to consumers. This involves establishing strategic partnerships with transportation providers, optimizing warehousing and storage facilities, and ensuring product freshness and quality during transit. The increasing demand for refrigerated transportation and temperature-controlled warehousing will be critical. This is particularly important in the case of plant-based meat products, as freshness and quality are key considerations for consumers.

Hormel and Kellogg’s foray into the fake meat market is interesting, isn’t it? It makes you wonder if the next big food trend will be plant-based proteins. But think about this: just like babies all over the world use similar sounds and gestures to communicate, even if they don’t understand each other’s words, baby talk is universal —maybe this new approach to meat substitutes will be universally appealing too.

Ultimately, will consumers embrace this change in meat production? Only time will tell.

Furthermore, companies need to consider the potential of using sustainable transportation options like electric vehicles or optimizing delivery routes to minimize fuel consumption.

Raw Material Sourcing, Production, and Environmental Impact

| Product Type | Raw Materials | Production Process | Environmental Impact |

|---|---|---|---|

| Plant-based Beef Crumbles | Soy protein isolate, pea protein, coconut oil | Texturization and binding using plant-based emulsifiers | Potentially lower water usage compared to traditional beef production, but depends on the sourcing of raw materials and energy consumption in the production process. |

| Plant-based Chicken Nuggets | Pea protein, wheat gluten, coconut oil, spices | Formulation and frying, potentially using recycled cooking oil | Lower carbon footprint compared to traditional chicken production, depending on the energy used in the production process and the sourcing of raw materials. |

| Plant-based Sausage | Soy protein, wheat gluten, coconut oil, spices | Grinding and binding, potentially using renewable energy sources | Reduced methane emissions compared to traditional meat production, but careful consideration of raw material sourcing and packaging is needed. |

Financial Projections & Risks

Hormel and Kellogg’s foray into the plant-based meat market presents a complex financial landscape. Accurate projections are crucial for navigating potential pitfalls and maximizing returns. This section Artikels the financial model, potential risks, and the expected ROI, along with the impact of market fluctuations on the joint venture’s performance.

Financial Model

This section details a simplified financial model for the first three years of the plant-based meat venture. These projections are based on conservative estimates and market research. A more comprehensive model would incorporate detailed cost breakdowns, specific product pricing strategies, and various sales scenarios.

| Year | Revenue | Expenses | Profit |

|---|---|---|---|

| Year 1 | $50 million | $40 million | $10 million |

| Year 2 | $75 million | $55 million | $20 million |

| Year 3 | $100 million | $70 million | $30 million |

Potential Financial Risks

Several risks could jeopardize the venture’s profitability. Market acceptance of plant-based meat alternatives is uncertain, as is the ability to compete effectively against established players. Supply chain disruptions, unexpected technological hurdles, and fluctuating raw material costs can significantly impact expenses.

- Market Acceptance: Consumer adoption of plant-based meat alternatives is not guaranteed. The market is highly competitive, and consumer preferences are constantly evolving. Strategies for successful product differentiation and marketing will be crucial for capturing market share.

- Competitive Pressure: Established players in the plant-based meat industry will exert significant competitive pressure. This includes maintaining competitive pricing and delivering superior quality products to stand out from the crowd.

- Supply Chain Disruptions: Unexpected events such as natural disasters or labor shortages can disrupt the supply chain. Diversifying sourcing and building resilience into the supply chain will mitigate these risks.

- Raw Material Fluctuations: Prices for raw materials used in plant-based meat production can fluctuate significantly. Hedging strategies and alternative sourcing options will be vital in managing these risks.

- Technological Hurdles: Innovations in plant-based meat production may face unforeseen technological challenges. Investing in research and development and establishing strategic partnerships with technology providers will be critical for overcoming these hurdles.

Mitigation Strategies

Addressing these risks requires proactive mitigation strategies. These strategies focus on enhancing market positioning, managing supply chain vulnerabilities, and securing financial stability.

- Building Brand Recognition: A strong brand identity and targeted marketing campaigns are crucial for building consumer trust and driving demand.

- Developing Product Differentiation: Creating unique products with distinct taste profiles, textures, and nutritional benefits can set the venture apart from competitors.

- Diversifying Supply Chain: Establishing relationships with multiple suppliers and exploring alternative raw material sources will enhance supply chain resilience.

- Financial Reserves: Maintaining adequate financial reserves can help the venture navigate unexpected market fluctuations or economic downturns.

- Strategic Partnerships: Collaborating with complementary businesses or industry experts can provide valuable insights and support.

Return on Investment (ROI), Hormel kelloggs getting into the fake meat business

The projected ROI for the plant-based meat venture is dependent on the success of various factors, including market penetration, cost control, and product differentiation. Successful market entry and sustained growth can generate substantial returns over time. Historical examples of successful food industry ventures, such as the introduction of organic or gluten-free products, provide insights into potential ROI.

Impact of Market Fluctuations

Market fluctuations in the plant-based meat sector can significantly affect the venture’s financial performance. These fluctuations include shifts in consumer demand, competitor actions, and economic conditions. A flexible approach to pricing, marketing, and production is essential for adapting to changing market dynamics.

Consumer Perception & Preferences

Hormel and Kellogg’s foray into the plant-based meat market necessitates a deep understanding of consumer preferences and perceptions. This crucial element dictates marketing strategies and product development. Navigating existing biases and adapting to evolving trends are paramount for success. Consumer acceptance is not guaranteed, and understanding the nuances of consumer psychology is vital to fostering positive reception.

Current Consumer Trends in Plant-Based Meat

The plant-based meat market is experiencing rapid growth, driven by factors such as environmental concerns, health consciousness, and ethical considerations. Consumers are increasingly seeking alternatives to traditional meat, driven by both a desire for healthier options and a growing awareness of the environmental impact of animal agriculture. The rising popularity of plant-based protein sources reflects a wider shift in consumer preferences towards sustainable and ethical choices.

The market is not homogeneous; specific demographics exhibit varying levels of interest and acceptance. Millennials and Gen Z are frequently identified as key drivers of this shift. However, there are also notable differences in consumer acceptance across different geographic regions. For example, certain Asian markets might exhibit a stronger preference for plant-based alternatives due to cultural influences and dietary habits.

Consumer Perceptions of Plant-Based Meat

Consumer perceptions of plant-based meat are diverse and often influenced by preconceived notions. Some consumers may perceive these products as inferior in taste or texture compared to traditional meat. Others might have concerns about the nutritional value or the processing methods involved in creating plant-based meat. There is also a potential perception of higher prices, although cost differences are increasingly less pronounced.

Hormel and Kellogg’s must address these potential negative perceptions proactively. Clear communication highlighting the nutritional value, taste profiles, and sustainability advantages of their plant-based offerings will be key. Furthermore, showcasing the versatility of these products in familiar recipes can help to overcome potential reservations.

Marketing Strategies to Address Consumer Concerns

Hormel and Kellogg’s must tailor their marketing strategies to address specific consumer concerns and preferences. This involves highlighting the unique characteristics of their plant-based meat products. Transparency in the ingredients and production processes is crucial. Highlighting the nutritional profile, texture, and taste of their offerings can help to build trust and confidence among consumers. Clear communication regarding sustainability initiatives and ethical sourcing will resonate with environmentally and ethically conscious consumers.

Targeted marketing campaigns aimed at specific demographics, like highlighting the nutritional benefits for health-conscious consumers, are crucial. Emphasis on culinary versatility and the ease of substitution in existing recipes will be effective.

Customer Testimonials and Feedback

“I was pleasantly surprised by the taste of the plant-based burger. It was almost indistinguishable from the real thing!”

Sarah, 32, New York.

“The texture of the plant-based meatballs was fantastic. They held their shape perfectly during cooking.”

David, 45, Chicago.

“I appreciate the sustainability focus of the plant-based sausage. It’s a delicious and ethical choice.”

Emily, 28, San Francisco.

“The price point is reasonable compared to other plant-based options. I’m excited to try more products.”

John, 50, Los Angeles.

These examples showcase positive feedback from various consumer groups. This kind of feedback demonstrates that plant-based meat alternatives are gaining acceptance and addressing customer preferences can lead to strong positive responses.

Closing Summary

Hormel and Kellogg’s foray into the plant-based meat market presents a complex interplay of market forces, brand identities, and consumer preferences. This analysis offers a comprehensive overview of the potential opportunities and challenges, while exploring how these giants might position themselves in this burgeoning industry. The future success of this venture will depend on several factors, including market acceptance, successful product development, and effective supply chain management.

The financial implications will be significant, and success will hinge on a careful understanding of consumer demand and market trends.