Obamacare enrollment period is open again whats new this year – Obamacare enrollment period is open again, what’s new this year? Navigating the health insurance landscape can be tricky, but this year’s open enrollment period offers some exciting updates and changes. From updated plans and eligibility criteria to potentially shifting premium costs, understanding these changes is key to securing the best coverage for your needs. Let’s dive in and explore what’s new for 2024!

This year’s open enrollment period brings several key changes to the marketplace plans. These changes affect eligibility, premium costs, and even the overall enrollment process. We’ll break down the details, providing a clear understanding of the adjustments and their implications. Expect to find information on how subsidies affect affordability and the range of health plans available.

Enrollment Period Overview

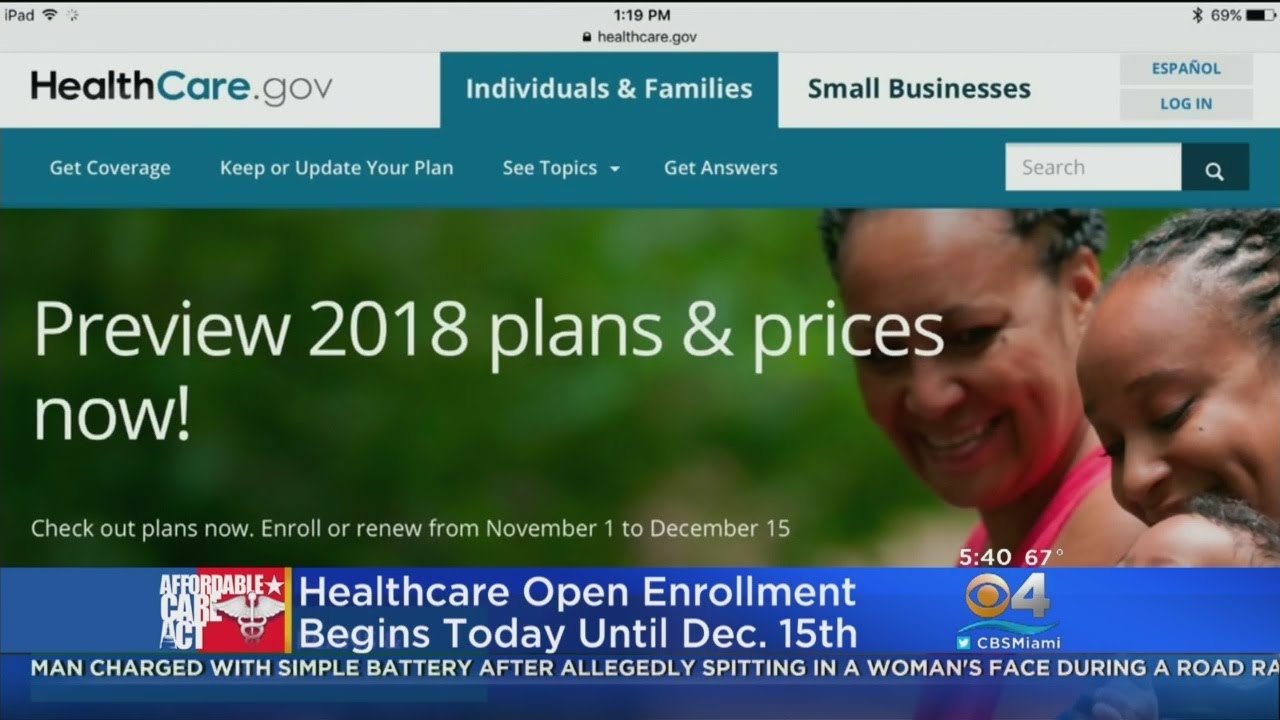

The Affordable Care Act (ACA) open enrollment period is a crucial time for individuals seeking health insurance coverage. This period allows people to compare plans, enroll in a new plan, or make changes to their current coverage. Navigating this process can be complex, but understanding the dates and deadlines is key to securing the necessary healthcare protection.

Open Enrollment Period Summary

The ACA open enrollment period is a set time frame each year when individuals can sign up for health insurance plans offered through the HealthCare.gov marketplace. This period is essential for those seeking coverage as it provides a structured opportunity to secure affordable healthcare options. Failure to enroll during this period may lead to a gap in coverage or higher premiums in future enrollment periods.

Enrollment Dates and Deadlines

| Dates | Actions | Deadlines |

|---|---|---|

| November 1, 2023 | Open Enrollment Begins | |

| December 15, 2023 | Special Enrollment Periods Open for Qualifying Life Events | |

| January 15, 2024 | Last Day to Enroll for Coverage Starting January 1, 2024 | |

| January 15, 2024 | Last Day to Enroll in a plan for coverage starting on February 1, 2024 | |

| January 15, 2024 | Last Day to Enroll in a plan for coverage starting on March 1, 2024 | |

| January 15, 2024 | Last Day to Enroll for Coverage Starting April 1, 2024 |

These dates and deadlines are critical for individuals to understand and plan accordingly. Knowing when the enrollment period opens and closes helps individuals ensure they do not miss the opportunity to obtain coverage. There are often special enrollment periods available for qualifying life events.

Key Changes for 2024: Obamacare Enrollment Period Is Open Again Whats New This Year

The 2024 Affordable Care Act (ACA) enrollment period is here, and with it come some significant changes to the marketplace plans. Understanding these shifts is crucial for making informed decisions about health insurance. Navigating the complexities of health insurance can be daunting, but hopefully this overview simplifies the process.The ACA continues to evolve, responding to economic shifts and evolving healthcare needs.

These changes affect both the types of plans available and the costs associated with them. This review will focus on the most notable adjustments to help you understand the implications of these changes.

Notable Changes to Marketplace Plans

The availability of plans in the marketplace often reflects changes in the healthcare landscape. New plans may offer different benefits, and some plans may disappear altogether. The focus on preventative care, telehealth, and mental health resources is expected to be a key factor in plan design this year.

Modifications to Eligibility Criteria

Eligibility for health insurance through the marketplace can be affected by several factors. These factors can include income levels, family size, and geographic location. These criteria are adjusted periodically to reflect evolving economic realities and demographic shifts. This year’s adjustments will likely affect eligibility thresholds, and individuals are encouraged to consult the official guidelines.

Potential Shifts in Premium Costs

Premium costs for health insurance plans are influenced by a complex interplay of factors. These include factors such as inflation, healthcare provider costs, and the overall health of the insured population. Changes in the economy and the availability of healthcare resources can impact premium costs significantly. It is important to carefully analyze the impact of these factors on your particular situation.

For example, if the cost of prescription drugs increases, insurance companies may adjust their premiums to reflect this.

Comparison of Premium Costs for Different Plans

Understanding the costs associated with various plans is essential for choosing the most suitable option. This table provides a simplified comparison of average premium costs across different regions for various plan types. Note that these are estimates and actual costs may vary based on individual circumstances.

| Region | Bronze Plan Premium (Estimated) | Silver Plan Premium (Estimated) | Gold Plan Premium (Estimated) |

|---|---|---|---|

| Northeast | $350/month | $500/month | $650/month |

| Midwest | $300/month | $450/month | $600/month |

| South | $250/month | $400/month | $550/month |

| West | $325/month | $475/month | $625/month |

New Features and Improvements

The 2024 Affordable Care Act (ACA) enrollment period brings a renewed focus on user-friendliness and accessibility. This year, the focus is on simplifying the navigation process and providing more personalized support to help consumers make informed decisions. Improvements in online tools and resources are designed to address the unique needs of diverse populations.

Simplified Enrollment Process

The ACA website has undergone significant upgrades to streamline the application process. Interactive tools and clear explanations are now more prominent. This aims to reduce the confusion and frustration often associated with navigating complex healthcare plans. By using easily digestible information and intuitive designs, the process of choosing a plan is less intimidating. The updated website design prioritizes a user-centered approach, leading to a more positive and efficient enrollment experience.

Enhanced Online Tools and Resources

Online tools are now more sophisticated and provide better comparisons of health plans. Interactive calculators help users estimate their potential monthly costs based on their individual circumstances. The site now offers detailed plan comparisons, including coverage details, provider networks, and out-of-pocket costs. This empowers consumers with the knowledge they need to choose a plan that aligns with their specific needs and budget.

New Tools and Resources for Consumers

To assist consumers in navigating the complexities of health insurance, several new resources are available. These resources are aimed at providing comprehensive support throughout the enrollment period.

- Personalized Recommendations: The website now offers personalized recommendations based on users’ input. This helps narrow down choices and guides users toward plans that are most likely to meet their individual needs. This feature is designed to be more user-friendly, presenting options tailored to individual situations.

- Interactive Health Plan Comparison Tool: This tool enables users to compare different health plans side-by-side, focusing on specific features and cost breakdowns. It helps users make more informed decisions about coverage options, provider networks, and out-of-pocket costs.

- Dedicated Support Channels: The ACA website now features a dedicated helpline and online chat support. This provides direct access to trained specialists who can answer questions, address concerns, and guide users through the enrollment process.

- Multilingual Support: The ACA website and resources are now available in multiple languages. This accessibility feature allows a wider range of individuals to understand and utilize the information.

- Educational Materials: A wealth of educational materials, including videos, infographics, and downloadable guides, are available to provide users with a better understanding of the enrollment process and health insurance plans. This facilitates easy access to information in various formats.

Cost Considerations and Affordability

Navigating healthcare costs can feel overwhelming, especially during open enrollment. Understanding how subsidies work and how the marketplace manages cost differences across plans and regions is crucial for making informed decisions. This section dives into the specifics of affordability in the Affordable Care Act marketplace.Subsidies play a vital role in making health insurance more accessible. They are financial assistance amounts determined by factors like income, household size, and location.

This assistance directly reduces the premium costs for eligible individuals and families, thereby increasing affordability.

Subsidy Impact on Affordability

Subsidies are a crucial component of the Affordable Care Act marketplace. They help eligible individuals and families afford health insurance by reducing the cost of premiums. These subsidies are calculated based on factors like income and family size, ensuring that those with lower incomes receive greater financial assistance. The goal is to make healthcare coverage attainable for a broader range of individuals.

Adjustments to Subsidy Calculation Methods

The calculation methods for subsidies are periodically reviewed and updated to reflect changes in the economic landscape and ensure accuracy. These adjustments may involve alterations to the formulas or criteria used to determine the amount of assistance provided. The aim is to maintain the effectiveness of subsidies in helping eligible individuals afford healthcare. This ensures that the subsidy system remains relevant and responsive to evolving economic realities.

Marketplace Navigation of Cost Differences

The healthcare marketplace strives to provide a range of plans to meet the diverse needs and budgets of consumers. The marketplace itself works to connect individuals with plans that best fit their requirements, while also addressing cost differences across regions. The marketplace employs a variety of tools and resources to help users compare plans based on factors like premiums, deductibles, and coverage options.

So, the Obamacare enrollment period is open again! What’s new this year? Well, while we’re focusing on health insurance, it’s important to remember the concerning rise in flavored tobacco use among teens. This alarming trend, detailed in a recent article on flavored tobacco use rising again among teens , highlights the need for comprehensive health awareness campaigns.

Regardless, hopefully, this year’s Obamacare enrollment period offers some fresh improvements to make navigating the process a bit smoother.

Premium Differences Across Plans and Regions

The cost of health insurance varies significantly across different plans and regions. This is due to factors such as the specific providers included in the network, the types of services covered, and the overall cost of healthcare services in a given area. The marketplace attempts to account for these differences to provide a comprehensive and equitable experience for consumers.

| Region | Plan A (High Deductible) | Plan B (Moderate Deductible) | Plan C (Lower Deductible) |

|---|---|---|---|

| Northeast | $300/month | $450/month | $600/month |

| Midwest | $250/month | $400/month | $550/month |

| South | $200/month | $350/month | $500/month |

| West | $350/month | $500/month | $650/month |

These examples represent a simplified illustration of potential premium differences. Actual premiums may vary based on individual factors, such as age, health status, and specific choices made during enrollment. The marketplace is designed to provide a variety of plans, and the goal is to match consumers with the most suitable plan for their budget and needs.

Health Coverage Options

Navigating the world of health insurance plans can feel overwhelming. The Affordable Care Act (ACA) marketplace offers a variety of plans, each with its own set of benefits and costs. Understanding these options is crucial for making an informed decision about your health coverage. Choosing the right plan depends on your individual needs and budget.

Plan Types and Coverage Options

The marketplace offers several plan types, each with different levels of coverage. Understanding the differences is key to selecting the best fit for your health needs. Metal tiers, ranging from Bronze to Platinum, represent varying levels of cost-sharing responsibilities. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums but lower out-of-pocket costs.

The Obamacare enrollment period is open again, and I’m curious about the updates this year. While navigating health insurance options, it’s worth remembering that new sub variants of omicron, like BA.4 and BA.5, are circulating. Checking out the latest info on new sub variants of omicron detected what to know about ba 4 and ba 5 could help you make informed decisions about your health.

Hopefully, these factors won’t impact the enrollment process too drastically.

Factors Influencing Plan Selection, Obamacare enrollment period is open again whats new this year

Several factors play a significant role in choosing the right health plan. Your location, family size, income, and individual health conditions all contribute to the most suitable plan. A comprehensive review of your financial situation and health history will aid in the selection process. Also consider the availability of specialists in your network, the specific benefits offered, and the overall cost-effectiveness of each option.

Comparison of Health Plans

| Plan Type | Premium (Example) | Deductible (Example) | Copay (Example) | Coverage Highlights |

|---|---|---|---|---|

| Bronze | $150/month | $2,000 | $20 | Basic medical services; lower monthly costs but higher out-of-pocket expenses. |

| Silver | $200/month | $1,500 | $30 | Moderate coverage; balance between premium and out-of-pocket expenses. |

| Gold | $250/month | $1,000 | $40 | Comprehensive coverage; higher premiums, but lower out-of-pocket expenses. |

| Platinum | $300/month | $500 | $50 | Extensive coverage; highest premiums, but lowest out-of-pocket expenses. |

This table provides a simplified comparison. Actual premiums, deductibles, and copays can vary significantly based on location and specific plan details. Carefully review the fine print and consider your individual circumstances before making a selection. Comparing plans across multiple carriers is essential for obtaining a full perspective.

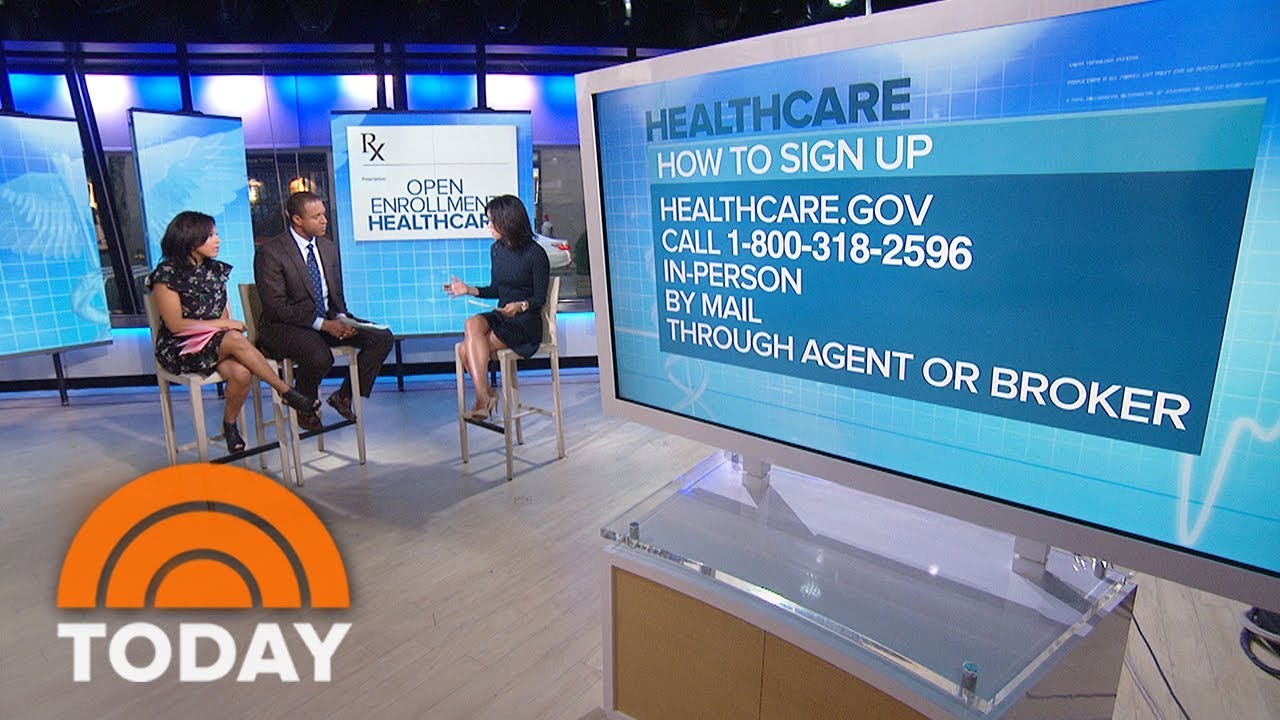

Accessing Support and Resources

Navigating the complexities of health insurance enrollment can be daunting. Fortunately, numerous resources are available to guide you through the process, ensuring you understand your options and make informed decisions. Whether you need assistance with comparing plans, understanding coverage details, or simply have a quick question, support is readily accessible.This section details the various support channels and resources available to simplify your enrollment journey.

Understanding these options empowers you to effectively utilize available assistance and ultimately choose the right health insurance plan for your needs.

Support Channels

A variety of communication channels provide support during the enrollment period. This allows users to connect with helpful agents based on their preferred method of communication.

- Phone support offers direct interaction with knowledgeable representatives who can address your specific questions and concerns in real-time. This is often the most effective method for complex issues or situations requiring immediate clarification.

- Email support provides a convenient way to submit questions and receive responses at your own pace. This is ideal for individuals who prefer asynchronous communication.

- Online chat facilitates instant support through a real-time text-based interface. This is a fast and accessible method for addressing simple inquiries or clarifying immediate concerns.

Helpful Resources

Numerous resources are available to assist you with the enrollment process. These resources offer comprehensive information, providing a solid foundation for understanding your options.

- The official website of the healthcare exchange provides a wealth of information on available plans, coverage details, and enrollment procedures. This website serves as a central hub for crucial details.

- Frequently Asked Questions (FAQs) pages offer concise answers to common enrollment-related questions. This is a great starting point for quick answers to simple questions.

- Brochures and pamphlets offer a detailed overview of various health insurance plans, including cost estimates, coverage details, and important considerations. These resources offer a structured format for comprehensive plan comparison.

- Videos and webinars provide interactive explanations of the enrollment process and plan features. These visual aids enhance understanding and provide an engaging way to learn about plans and the enrollment process.

- Community forums and support groups offer opportunities to connect with other individuals facing similar questions or challenges. These online communities foster a supportive environment where individuals can share experiences and learn from others.

Contact Information

This table provides a summary of contact information for various support channels.

| Support Channel | Contact Information |

|---|---|

| Phone Support | 1-800-XXX-XXXX (or similar) |

| Email Support | [email protected] (or similar) |

| Online Chat | Available on the healthcare exchange website (or similar) |

Enrollment Process Overview

Navigating the healthcare marketplace can feel daunting, but the enrollment process for Obamacare is designed to be straightforward. Understanding the steps involved and the resources available can ease the process significantly. This section provides a detailed overview of the enrollment journey, from initial access to the platform to submitting your application.The online enrollment platform serves as the central hub for the entire process.

It’s designed to guide users through each step, providing clear instructions and support along the way. By following the steps Artikeld below, you can successfully complete your application and secure affordable health coverage.

Accessing the Online Enrollment Platform

The online enrollment platform is typically accessible through a dedicated website. You can locate the official site through online searches or by visiting the official government health insurance marketplace. Once on the site, look for the enrollment portal, often prominently displayed.

Requirements and Documents

To complete the enrollment process smoothly, gather the necessary documents beforehand. This will streamline the process and ensure a timely approval.

- Personal Information: This includes your name, date of birth, Social Security number, and contact details. These are fundamental to verifying your identity and eligibility.

- Income Information: Accurate income details are essential to determine eligibility for financial assistance and appropriate premium levels. This may include pay stubs or tax returns.

- Family Information: If applicable, information about family members needing coverage is required. This includes their names, dates of birth, and relationships to you.

- Proof of Citizenship or Legal Residency: Valid documentation proving your citizenship or legal residency status in the country is often needed.

- Previous Insurance Information: If you’ve had health insurance in the past, details of your previous coverage may be needed for the enrollment process.

Step-by-Step Enrollment Guide

The enrollment process is typically straightforward, broken down into manageable steps.

Understanding the steps and gathering necessary information beforehand will ensure a smooth and efficient process.

-

Step 1: Create an AccountOn the platform, create an account by providing the requested personal and contact details. Choose a strong password for security.

-

Step 2: Enter Personal and Family InformationInput accurate details for yourself and any family members requiring coverage. This includes names, dates of birth, and relationships.

-

Step 3: Provide Income InformationSubmit your income details to determine eligibility for financial assistance and premium affordability. This may include pay stubs or tax returns.

-

Step 4: Select Health Coverage OptionsExplore different health plan options and choose the coverage that best meets your needs and budget. Compare premiums, deductibles, and other features.

-

Step 5: Review and Submit ApplicationCarefully review all the entered information to ensure accuracy. Submit your completed application for processing.

The Obamacare enrollment period is open again, and I’m curious about what’s new this year. While researching, I stumbled across some fascinating information about how misleading YouTube videos on plastic surgery can be, which is a whole other rabbit hole. Thankfully, there are plenty of reliable resources available to help navigate the complexities of the enrollment process, so hopefully, this year’s changes are easier to understand than in previous years.

youtube videos on plastic surgery are misleading This will hopefully be a straightforward enrollment process.

Illustrative Scenarios

Navigating the complexities of healthcare coverage can be daunting, especially during open enrollment. Understanding how different situations affect your choices is crucial for selecting the right plan. These scenarios offer a glimpse into potential outcomes and help you make informed decisions.

Family with Young Children

A family with two young children, one of whom has a pre-existing condition, faces unique considerations. Affordable Care Act (ACA) plans often provide subsidies to lower premiums. The presence of a pre-existing condition doesn’t necessarily mean higher premiums, as the ACA mandates that insurers cannot discriminate based on pre-existing conditions.

- Scenario 1: The family opts for a plan with a higher deductible. This could lead to significant out-of-pocket expenses if a child requires frequent doctor visits. However, lower monthly premiums might offset these costs, depending on their income and the specifics of the plan.

- Scenario 2: The family chooses a plan with a lower deductible but higher monthly premiums. This provides greater financial security during an unexpected illness or injury. This choice balances out the cost of monthly payments with potential future expenses.

Single Adult with Limited Income

Individuals with limited income may qualify for substantial subsidies. These subsidies can significantly reduce the cost of premiums, making healthcare coverage more accessible.

- Scenario 1: A single adult with a part-time job can potentially receive substantial subsidies, enabling them to choose a plan that best suits their budget and healthcare needs.

- Scenario 2: A single adult with a slightly higher income may receive smaller subsidies, but still, find the cost of insurance significantly lowered. The exact amount of subsidy depends on their income and the plan chosen.

Couple with High Income

A couple with high incomes might not qualify for subsidies. Their monthly premiums could be higher than those of lower-income individuals. However, they still have access to a range of plans.

- Scenario 1: The couple chooses a plan with a high deductible and low monthly premiums, balancing potential future out-of-pocket costs with reduced monthly expenses. This decision is appropriate for those who are financially secure and anticipate fewer healthcare needs.

- Scenario 2: The couple selects a plan with a lower deductible and higher monthly premiums. This approach offers greater financial security in the event of unexpected medical expenses.

Table Summarizing Scenarios

| Scenario | Income Level | Key Considerations | Implications for Coverage |

|---|---|---|---|

| Family with Young Children | Moderate | Pre-existing condition, need for frequent doctor visits | Higher deductibles, potentially lower monthly premiums; balance between cost and coverage |

| Single Adult with Limited Income | Low | Limited income, significant need for subsidies | Substantial subsidies available, significant savings on monthly premiums |

| Couple with High Income | High | No subsidies, higher premiums possible | Wider range of plans; higher premiums, higher deductibles |

Wrap-Up

In summary, the 2024 Obamacare open enrollment period offers a chance to explore updated health insurance options and potentially find more affordable coverage. Understanding the key changes, from new plan features to potential shifts in premium costs, is crucial for making informed decisions. We’ve covered the essentials to help you navigate the process and find the best fit for your needs.

Remember to carefully review the details, consider your circumstances, and don’t hesitate to reach out for support along the way!