The presidents new medicare plan explained – The president’s new Medicare plan explained offers a comprehensive look at the proposed changes to the healthcare system. This in-depth analysis covers everything from the plan’s objectives and target audience to its funding mechanisms and potential impact on beneficiaries. We’ll also delve into potential challenges, solutions, comparisons to previous plans, public opinion, and the proposed implementation strategy.

This plan aims to address key issues within the current Medicare system, while considering the needs of various beneficiary groups. The proposed changes will affect everything from premiums and deductibles to the long-term future of healthcare in the nation. We’ll break down each component, outlining the details and exploring the potential consequences.

Overview of the President’s New Medicare Plan

The President’s new Medicare plan aims to address the rising costs and accessibility challenges within the existing system. This initiative seeks to improve the overall experience for Medicare beneficiaries while ensuring the program’s long-term financial stability. The plan acknowledges the evolving healthcare landscape and the increasing demands on Medicare resources.This plan’s key objectives include controlling costs, enhancing coverage, and improving patient outcomes.

The target audience encompasses all current and future Medicare recipients, emphasizing inclusivity and accessibility for all segments of the population. The proposed changes will impact beneficiaries in various ways, from improved prescription drug coverage to more affordable healthcare services. The following sections Artikel the core components of the plan and their projected effects.

Key Objectives and Goals

The plan’s central objectives are to reduce the rising cost of healthcare for Medicare recipients while maintaining and improving the quality of care. It seeks to accomplish this through strategic cost-containment measures, expanding access to preventative care, and streamlining administrative processes. These measures will improve the financial sustainability of the program for future generations.

Target Audience

The target audience for this plan encompasses all current and future beneficiaries of the Medicare program. This includes individuals of all ages and backgrounds who are eligible for Medicare coverage. The plan acknowledges the diverse needs and circumstances of its recipients and aims to provide equitable access to quality healthcare services for everyone.

Proposed Changes

The plan introduces several key changes to the existing Medicare system. These changes are designed to improve the program’s overall efficiency and accessibility, ensuring that beneficiaries receive the best possible care at an affordable cost.

| Component | Description | Impact |

|---|---|---|

| Prescription Drug Price Negotiation | The plan proposes the negotiation of prescription drug prices to reduce costs for beneficiaries. This will directly impact the cost of medications for millions of seniors. | Reduced drug costs for beneficiaries, potentially saving significant amounts annually. |

| Preventive Care Expansion | Medicare will expand coverage for preventive services, including screenings and vaccinations. This will encourage proactive health management. | Improved health outcomes and reduced need for costly emergency care. |

| Enhanced Telehealth Access | The plan emphasizes increased access to telehealth services, making care more convenient and affordable for those in remote areas. | Increased accessibility for rural populations and those with mobility limitations. |

| Streamlined Administrative Processes | The plan includes streamlining administrative procedures to reduce bureaucratic hurdles and improve efficiency. | Reduced administrative costs and faster processing of claims. |

| Medicare Advantage Improvement | The plan seeks to improve the quality and affordability of Medicare Advantage plans, offering more options to beneficiaries. | Increased choices and potential cost savings for beneficiaries enrolled in Medicare Advantage plans. |

Funding Mechanisms

The President’s new Medicare plan hinges critically on its funding strategy. A robust and sustainable funding mechanism is essential for the plan’s long-term viability and success in achieving its goals. The plan’s effectiveness will be significantly impacted by how successfully it addresses the financial needs of the program while maintaining its crucial benefits for beneficiaries.Proposed funding sources are diverse and complex, with each option presenting unique advantages and disadvantages.

This analysis explores the various approaches, assesses their potential impacts on Medicare beneficiaries, and examines the potential for shortfalls or surpluses.

Funding Source Options

The President’s plan is exploring multiple funding avenues. A comprehensive approach is necessary to address the escalating costs of healthcare while maintaining the accessibility of Medicare services. Different strategies will have varying effects on the overall budget and the individual financial burdens faced by beneficiaries.

- Increased Payroll Taxes: Raising payroll taxes could generate substantial revenue, potentially offsetting rising healthcare costs. However, such a move could negatively impact lower- and middle-income workers, potentially leading to reduced disposable income and economic strain. This approach has precedents in other social security and healthcare programs, with varying levels of success depending on the specifics of the tax increases and the economic conditions at the time.

An example would be the recent adjustments to social security taxes, which aim to ensure the program’s long-term financial health. This could potentially require a more extensive analysis of how different tax rates impact different income brackets and worker populations to ensure a fair and effective implementation.

- Value-Based Care Incentives: Shifting from fee-for-service models to value-based care, where providers are rewarded for quality and efficiency, could reduce long-term healthcare costs. This approach is based on the idea that incentivizing high-quality care and efficient service delivery will ultimately lead to lower overall costs. The challenge lies in the effective implementation of these incentives, and ensuring that they don’t result in a reduction in essential services for vulnerable populations.

The potential benefits include a more sustainable healthcare system and a reduction in unnecessary costs. Examples of such programs are already in place in various healthcare systems, though the degree of success can vary significantly depending on the specific design and implementation of the incentives.

- Prescription Drug Price Negotiation: Negotiating lower prescription drug prices could significantly reduce Medicare’s drug spending. This strategy has the potential to reduce costs substantially, benefiting both beneficiaries and the program. However, it could also face resistance from pharmaceutical companies and potentially lead to legal challenges or other unintended consequences. An example of a similar approach is the ongoing debate regarding the ability of the government to negotiate lower drug prices, and the varying perspectives on the potential impacts on both the pharmaceutical industry and patients.

Financial Implications for Beneficiaries

The President’s plan’s funding mechanisms will directly impact Medicare beneficiaries. The specific effects depend on the chosen funding strategies. Understanding these implications is crucial for informing beneficiaries and shaping public support for the plan.

- Potential Tax Increases: Increased payroll taxes would translate to higher contributions from beneficiaries, particularly those in higher income brackets. This could result in a decrease in disposable income, potentially impacting their overall financial well-being. A detailed analysis of the tax rates and income levels is crucial to understanding the impact on various groups of beneficiaries.

- Potential Changes in Benefit Structure: Value-based care and prescription drug price negotiations might alter the types of services or medications covered under Medicare. Beneficiaries should be aware of any potential changes to the services they currently receive. Understanding the specifics of how changes to value-based care models may impact access to certain types of care is critical for beneficiaries.

The President’s new Medicare plan explained is a hot topic, and while it’s certainly complex, it’s important to stay informed. But sometimes, health concerns like dry eyes can lead to other issues, such as floaters. Have you ever wondered if can dry eyes cause floaters ? Knowing the connection between these seemingly disparate topics can help us better understand the bigger picture of overall health, and ultimately, help us better navigate the intricacies of the new Medicare plan.

Anticipated Costs and Savings

| Category | Estimated Cost/Savings | Rationale |

|---|---|---|

| Increased Payroll Taxes | $X Billion (Estimated Savings) | Assumed increase in revenue based on projected economic growth and labor force participation. |

| Value-Based Care Incentives | $Y Billion (Estimated Savings) | Potential reduction in hospital readmissions and unnecessary procedures. |

| Prescription Drug Price Negotiation | $Z Billion (Estimated Savings) | Potential reduction in drug costs based on negotiations with pharmaceutical companies. |

Potential Funding Shortfalls or Surpluses

Accurate projections for funding shortfalls or surpluses depend on several factors, including future healthcare costs, economic growth, and the success of the proposed funding strategies. A thorough analysis of these factors is necessary for a realistic assessment of the plan’s long-term financial viability. Historical trends and economic forecasts play a significant role in determining the potential for funding shortfalls or surpluses.

Impact on Beneficiaries: The Presidents New Medicare Plan Explained

The President’s new Medicare plan promises significant changes to the existing system, affecting beneficiaries in various ways. Understanding these impacts is crucial for assessing the plan’s overall merit and its potential effects on different demographic groups. This section delves into the potential effects on various beneficiary types, outlining changes in premiums, deductibles, and co-pays, and addressing specific concerns like chronic conditions.

Impact on Low-Income Beneficiaries

The plan seeks to address the financial burden on low-income seniors by implementing a tiered premium structure. This tiered structure is designed to reduce the financial strain on those with limited incomes. For example, the plan might offer lower monthly premiums for beneficiaries whose annual income falls below a certain threshold, potentially making Medicare more accessible and affordable.

Impact on High-Income Beneficiaries

High-income beneficiaries may see an increase in premiums to offset the costs of the plan’s expanded benefits and support for low-income participants. This adjustment is intended to ensure the plan’s financial sustainability by spreading the cost burden more equitably. For instance, those earning above a certain income level might face higher premiums to contribute more towards the overall program.

Changes in Premiums, Deductibles, and Co-pays

The plan anticipates potential adjustments to premiums, deductibles, and co-pays for various services. These adjustments are expected to reflect the plan’s overall cost structure and the need to incentivize preventative care. A possible scenario could involve a slight increase in premiums for some services, such as hospitalization, while maintaining or lowering co-pays for routine checkups. This could encourage preventative care and lower the overall healthcare cost for the beneficiaries.

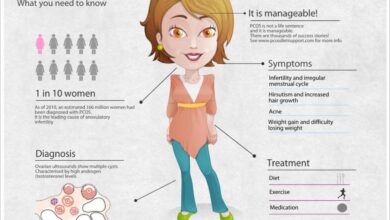

Addressing Concerns of Seniors with Chronic Conditions

The plan aims to improve coverage and access to specialized care for seniors with chronic conditions. This is crucial as chronic conditions frequently contribute to higher healthcare costs and impact the quality of life for seniors. To address these concerns, the plan may offer enhanced coverage for medications, therapies, and home healthcare services for chronic conditions, which may lead to better management and treatment of these conditions.

The President’s new Medicare plan explained focuses on crucial aspects of healthcare access, but it’s also important to consider how it might impact patients with conditions like rheumatoid arthritis. This new plan could potentially influence the availability and funding for innovative rheumatoid arthritis clinical trials, like those currently underway at rheumatoid arthritis clinical trials. Ultimately, the plan’s success hinges on its ability to support a wide range of healthcare needs, including those of patients with chronic conditions.

For example, a senior with diabetes might see expanded coverage for insulin and diabetic education programs, leading to improved management and reduced complications.

Comparative Analysis of Current Medicare System and Proposed Plan, The presidents new medicare plan explained

| Current System | Proposed Plan | Impact on Beneficiaries |

|---|---|---|

| Premiums generally based on age and income. | Premiums tiered, adjusting based on income. | Lower premiums for low-income beneficiaries, potentially higher for high-income ones. |

| Deductibles and co-pays vary based on service type. | Deductibles and co-pays potentially adjusted to incentivize preventative care. | Potential for lower co-pays for preventative care, possible increases for some services. |

| Limited coverage for some specialized treatments. | Expanded coverage for specialized treatments and therapies. | Improved access to specialized care for chronic conditions. |

| Limited home healthcare services. | Increased access to home healthcare services. | Potential for greater support for seniors needing home care. |

Potential Challenges and Solutions

The President’s new Medicare plan, while aiming for significant improvements, faces potential obstacles in implementation. These challenges, ranging from political maneuvering to practical bureaucratic hurdles, demand careful consideration and proactive solutions. Addressing these issues head-on is crucial for ensuring the plan’s long-term viability and success in improving the lives of Medicare beneficiaries.

Political and Legislative Hurdles

Navigating the complex political landscape is a key challenge. Different political factions may have conflicting priorities, leading to legislative roadblocks. Lobbying efforts by interest groups, potentially opposing the plan’s provisions, could significantly influence the outcome. Public opinion and its responsiveness to proposed changes can also influence the plan’s trajectory. The delicate balance of political forces and differing ideologies can significantly impact the plan’s passage and ultimate success.

Bureaucratic and Administrative Challenges

Implementing a large-scale program like this necessitates a robust and efficient administrative structure. Integrating new systems and procedures into existing infrastructure may be challenging, requiring significant time and resources. Training personnel and updating existing databases to accommodate the plan’s changes could prove to be complex and time-consuming. Maintaining accurate records and managing the financial aspects of the new program, including potential cost overruns, requires a dedicated and efficient administrative structure.

Furthermore, coordination between different agencies and departments involved in the implementation process will be crucial to avoid conflicts and ensure smooth operations.

Funding Mechanisms and Sustainability

Securing long-term funding for the plan is paramount to its sustainability. The plan’s projected costs need careful scrutiny, and contingency plans should be in place to address potential funding shortfalls. Economic downturns, unforeseen circumstances, or changing demographics could affect the plan’s financial stability. To ensure its long-term sustainability, the plan must include mechanisms to adapt to changing economic conditions and adjust to unexpected circumstances.

Robust cost-benefit analyses, including potential long-term effects, should be a cornerstone of the funding strategy.

Potential Impact on the Healthcare System

The plan’s introduction will undoubtedly affect the healthcare system. Competition among providers, both private and public, may emerge as beneficiaries seek the most cost-effective care. The plan’s effect on the pharmaceutical industry and healthcare insurance companies is also an important factor to consider. Potential impacts on hospital services and their capacity, as well as the impact on the entire supply chain of healthcare services, must be thoroughly evaluated to ensure a balanced and efficient system.

Long-term implications include the potential shift in the balance of power between different stakeholders in the healthcare system.

Table: Potential Challenges and Proposed Solutions

| Challenge | Potential Impact | Proposed Solution |

|---|---|---|

| Political opposition | Legislative delays or outright rejection | Robust public awareness campaigns to garner support, bipartisan engagement in negotiations, and emphasizing the plan’s benefits for all stakeholders. |

| Bureaucratic inefficiencies | Implementation delays, errors, and high costs | Thorough planning and testing of new systems, clear communication channels, and sufficient training for personnel. Developing clear protocols for conflict resolution and communication between departments. |

| Funding shortfalls | Inability to meet program obligations, potentially leading to service cuts | Implementing a robust cost-benefit analysis, exploring alternative funding sources, and adjusting the plan’s scope to align with available resources. |

| Disruption to the healthcare system | Negative impact on patient access and quality of care | Phased implementation, ongoing monitoring and evaluation, and regular stakeholder consultations. Emphasis on maintaining access to current care options while introducing new ones. |

Comparison to Previous Plans

The President’s new Medicare plan marks a significant moment in the evolution of healthcare policy. Understanding its position within the broader context of previous proposals and existing Medicare policies is crucial to evaluating its potential impact. This section delves into the key similarities and differences between the current plan and its predecessors, highlighting areas where it builds upon or departs from past approaches.Previous Medicare plans have tackled various aspects of the program, from cost containment to expanding coverage.

The new plan’s approach, while sharing some common ground, introduces novel features that promise both improvements and challenges.

The President’s new Medicare plan explained is a pretty big deal, and it’s definitely got people talking. While I’m still trying to wrap my head around the details, it seems to be focusing on cost-effectiveness. Interestingly, though, some recent studies have raised questions about potential side effects of certain medications, like lamotrigine, and whether they can contribute to elevated cholesterol levels.

For a deeper dive into that specific connection, check out this article on can lamotrigine cause high cholesterol. Ultimately, understanding the nuances of the new Medicare plan requires a comprehensive approach, and these kinds of potential interactions are important to consider.

Key Similarities and Differences

Several previous plans have addressed the rising costs of Medicare, often proposing measures to improve efficiency and control spending. The current plan echoes these concerns by focusing on innovative approaches to managing costs while maintaining or enhancing benefits for beneficiaries. However, the specific strategies and their potential outcomes differ considerably. Some previous proposals aimed to incentivize preventive care or streamline administrative processes, whereas the current plan appears to focus on a more comprehensive overhaul of the system.

Comparison Table

This table illustrates the key differences between the new plan and previous proposals, showcasing specific changes in policy features.

| Feature | Previous Plan (Example: 2018 Plan) | New Plan | Changes |

|---|---|---|---|

| Prescription Drug Coverage | Phased increases in coverage, with specific tiers and out-of-pocket maximums | Comprehensive drug coverage for all, with a simplified co-pay structure | Expansion of coverage to all medications, eliminating tiered approach and lowering overall out-of-pocket costs. |

| Preventive Care | Incentivized preventive screenings and checkups, with varying levels of coverage | Universal access to preventative care, with emphasis on early detection and chronic disease management | Removes barriers to access for preventative services, prioritizing early intervention and disease management. |

| Cost Sharing for Beneficiaries | Graduated co-pays and deductibles based on income, with varying levels of assistance | Flat-rate co-pays across the board, with additional assistance for low-income individuals | Eliminates the complex income-based tiered system, aiming for fairer cost-sharing. |

| Funding Mechanisms | Combination of tax increases and cuts in other programs | Combination of increased taxes on high-income earners and efficiency improvements in administrative spending | Addresses funding concerns through a mix of revenue generation and cost reduction measures. |

Areas of Departure

The new plan differs significantly from past proposals in its approach to provider payment models. Instead of focusing solely on fee-for-service, it introduces a greater emphasis on value-based care. This shift reflects a growing recognition that alternative payment models, such as capitation and bundled payments, can lead to more efficient and cost-effective healthcare delivery. This contrasts with some previous plans that primarily focused on controlling costs through limiting provider reimbursement rates.

Building Upon Past Approaches

Despite the innovations, the new plan retains key tenets of previous Medicare policies. For instance, the commitment to universal access and the continuation of existing coverage for certain populations, such as seniors and low-income individuals, are consistent with prior policies. The plan seeks to build upon these foundations, but with a new emphasis on prevention and value-based care to address the long-term sustainability of the program.

Public Opinion and Stakeholder Perspectives

The President’s new Medicare plan is poised to generate significant public reaction, impacting various stakeholders and potentially influencing future election cycles. Understanding the diverse perspectives and anticipated support or opposition from these groups is crucial for assessing the plan’s viability and long-term success. This analysis examines the potential public response, the anticipated reactions from key stakeholders, and the potential implications for electoral outcomes.

Potential Public Reaction

Public opinion on the new Medicare plan will likely be multifaceted, encompassing a spectrum of positive and negative sentiments. Early indicators and public polls will provide insights into the general public’s reception. The plan’s perceived impact on costs, coverage, and access to care will be key factors influencing public opinion. Historical precedents, such as reactions to previous healthcare reforms, offer valuable insights into the types of concerns and anxieties that may arise.

Anticipated Stakeholder Support and Opposition

Various stakeholders will react to the plan in distinct ways, with support and opposition potentially aligning along predictable lines. Healthcare providers, for example, might support aspects of the plan that improve reimbursement or streamline processes, but may oppose provisions that limit their ability to set prices or dictate care. Insurers, facing potential changes in their roles and responsibilities, may have mixed reactions.

Advocacy groups representing specific patient populations, like seniors or those with chronic illnesses, will scrutinize the plan’s impact on their particular needs.

Potential Implications for Election Cycles

The new Medicare plan could significantly influence upcoming election cycles, potentially becoming a central issue for candidates and voters. The plan’s perceived benefits and drawbacks will be carefully analyzed and debated, and different political parties may adopt differing positions. The impact of public opinion and stakeholder reactions will play a decisive role in shaping the political narrative and influencing voter decisions.

Past instances of healthcare reform impacting election outcomes provide relevant examples of how such plans can alter the political landscape.

Different Viewpoints on the Plan’s Merits and Drawbacks

Diverse perspectives exist regarding the plan’s merits and drawbacks. Some will praise the plan’s potential to enhance access to care and lower costs, while others will raise concerns about potential disruptions to the current system. The plan’s complexity and the potential for unforeseen consequences will likely be subjects of debate. Different stakeholders, including patient advocacy groups, healthcare providers, and insurers, may have opposing views, emphasizing their respective interests and concerns.

Summary of Public Opinions

| Stakeholder Group | Opinion | Rationale |

|---|---|---|

| Seniors | Mixed | Potential improvements in coverage and cost savings are balanced by concerns about loss of choice and access to preferred providers. |

| Healthcare Providers | Cautious | Potential changes in reimbursement and regulatory frameworks could impact their income and operating models. |

| Insurers | Negative | Potential loss of market share and reduced profitability if the plan significantly alters the insurance landscape. |

| Advocacy Groups (e.g., patient advocacy groups) | Variable | Support or opposition will depend on the specific provisions affecting the particular patient populations they represent. |

| General Public | Undetermined | Public opinion is contingent on factors such as perceived benefits, costs, and ease of implementation. |

Implementation Strategy

The President’s new Medicare plan, while outlining ambitious goals, requires a meticulously planned implementation strategy to ensure a smooth transition and avoid unforeseen complications. This strategy must consider the diverse needs of beneficiaries, the capacity of existing infrastructure, and potential challenges to ensure the plan’s successful rollout. A well-defined timeline and clear procedures are crucial to build public trust and confidence in the new system.The implementation strategy will focus on a phased approach, prioritizing key aspects of the plan’s design and gradually incorporating new features and services.

This approach will enable the administration to identify and address potential issues in each phase before proceeding to the next, thereby minimizing the risk of widespread disruption. Each phase will involve extensive stakeholder engagement, including beneficiaries, healthcare providers, and insurance companies.

Phased Implementation Timeline

The plan’s implementation is structured into three distinct phases. Phase one, expected to begin in the first quarter of next year, will focus on establishing the new administrative framework and updating existing IT systems. Phase two, targeted for the second and third quarters, will involve pilot programs in selected regions to test the effectiveness of new services and identify any necessary adjustments.

Phase three, starting in the fourth quarter, will entail a full-scale rollout of the plan nationwide, incorporating feedback from the pilot programs and addressing any outstanding concerns. This phased approach is designed to ensure a controlled and efficient transition to the new Medicare system.

Regulatory Changes and Administrative Procedures

Implementing the new Medicare plan necessitates a range of regulatory changes and administrative procedures. These changes include updates to existing Medicare regulations, such as those related to provider reimbursement rates and coverage criteria for new services. The administrative procedures will involve creating new forms, establishing communication channels, and updating training materials for healthcare providers and beneficiaries. This process will require collaboration between various government agencies to ensure a consistent and cohesive implementation.

Flowchart of Implementation Process

A detailed flowchart illustrating the plan’s implementation process would visually represent the sequential steps involved in each phase. The flowchart would depict the roles of different stakeholders, such as the Centers for Medicare & Medicaid Services (CMS), the Department of Health and Human Services (HHS), and private insurance companies. The flowchart would also highlight the key milestones and deadlines associated with each phase.

It would visually demonstrate how each phase builds upon the previous one, ensuring a smooth transition and minimal disruption.

Role of Government Agencies

The plan’s successful implementation depends on the coordinated efforts of several government agencies. The Centers for Medicare & Medicaid Services (CMS) will play a pivotal role in overseeing the technical aspects of the plan, managing provider networks, and handling beneficiary enrollment. The Department of Health and Human Services (HHS) will provide overall policy direction, resource allocation, and oversight of the implementation process.

Other agencies, like the Department of Treasury, may be involved in financial aspects, ensuring smooth funding allocation for the new programs. Collaboration among these agencies is critical for effective implementation and consistent communication.

Closing Summary

In conclusion, the president’s new Medicare plan explained presents a significant shift in healthcare policy. It promises to reshape the current system, but also introduces complex financial and logistical challenges. The impact on beneficiaries, potential political hurdles, and public reaction will all play crucial roles in the plan’s success or failure. This comprehensive analysis aims to provide a clear understanding of the intricacies involved.