Walgreens to open doctor offices, a bold move that signals a significant shift in the healthcare landscape. This expansion promises to reshape primary care access, particularly in underserved communities. The move suggests a strategic partnership between retail and healthcare, potentially offering a more convenient and accessible approach to routine medical needs. This expansion into primary care raises many questions about the future of healthcare, including how Walgreens plans to integrate its existing infrastructure with medical services and how this might impact existing healthcare providers.

This exploration delves into the rationale behind this expansion, analyzing potential models for doctor offices, and assessing the impact on healthcare access, competition, and patient experience. We’ll examine the regulatory and ethical considerations, public perception, and the strategic marketing and branding strategies that Walgreens likely needs to employ to navigate this complex transition. The expansion’s potential to address healthcare disparities and improve access for underserved communities is also a key area of interest.

Walgreens’ Doctor Office Expansion: Walgreens To Open Doctor Offices

Walgreens, a familiar name in the American retail landscape, has been gradually expanding its role in healthcare beyond its traditional pharmacy services. The company’s foray into primary care, with the opening of doctor offices, represents a significant strategic shift, reflecting both evolving consumer demands and the potential for enhanced profitability. This move necessitates a careful analysis of the rationale behind this expansion, considering the historical context, market dynamics, and potential obstacles.The company’s existing presence in the healthcare sector, coupled with the increasing demand for convenient and accessible primary care, provides a compelling rationale for this expansion.

The potential for increased revenue streams and a strengthened market position are major drivers behind this initiative. However, the transition to offering medical services also presents numerous challenges, including navigating complex regulatory frameworks and competing with established healthcare providers.

Historical Overview of Walgreens’ Healthcare Presence

Walgreens has a long history of involvement in the healthcare sector, primarily focused on pharmacy services. The company’s vast network of stores provides a ready-made infrastructure for expanding into primary care. Past partnerships and collaborations with healthcare providers have also laid the groundwork for this expansion. These partnerships demonstrate Walgreens’ commitment to enhancing healthcare access and providing integrated services to its customers.

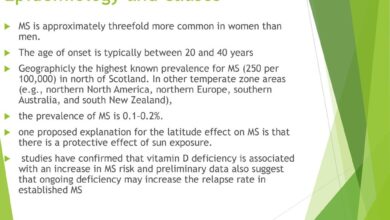

Evolving Healthcare Landscape and Consumer Demands, Walgreens to open doctor offices

The healthcare landscape is evolving rapidly, with an increasing emphasis on preventative care, accessible services, and personalized medicine. Consumers are seeking convenient and integrated healthcare solutions, often desiring a seamless transition between pharmacy and primary care. This trend aligns with Walgreens’ strategy to offer comprehensive healthcare options within a familiar retail setting. The growing demand for telehealth and virtual consultations further emphasizes the need for a more comprehensive approach to healthcare delivery.

Potential Financial Incentives and Strategic Advantages

Expanding into primary care offers potential financial incentives for Walgreens. The addition of physician services can significantly increase revenue streams beyond traditional pharmacy sales. Furthermore, a broader range of healthcare services can enhance customer loyalty and attract new customers. The integration of primary care services can also potentially create new revenue streams through ancillary services such as lab work and preventive screenings.

This integrated approach can attract customers who value a one-stop shop for their healthcare needs.

Potential Challenges and Risks

The expansion into primary care will undoubtedly face regulatory hurdles. Navigating licensing requirements, staffing needs, and maintaining compliance with healthcare regulations will be critical. Competition from existing healthcare providers is also a significant risk. The established players in the primary care market have substantial infrastructure and brand recognition. Walgreens must develop strategies to differentiate its offerings and attract patients to its new facilities.

Careful planning and execution are crucial for success in this competitive environment.

Walgreens’ Existing Infrastructure and Adaptability

Walgreens’ extensive network of stores provides a strong foundation for adapting to the needs of doctor offices. The existing retail infrastructure can be modified to create suitable examination rooms, waiting areas, and other necessary facilities. Efficient use of space and strategic placement of new facilities can maximize the impact of this expansion. The existing pharmacy infrastructure can be leveraged to streamline medication management and prescription refills for patients under the care of Walgreens physicians.

Potential Models for Walgreens Doctor Offices

Walgreens’ expansion into doctor office services presents a unique opportunity to bridge the gap in healthcare access for many communities. This expansion requires careful consideration of various models, each with its own set of strengths and weaknesses. Understanding these models is crucial to maximizing the potential benefits of these new healthcare facilities while ensuring their financial sustainability.The different models for Walgreens doctor offices must consider the diverse needs of the patient populations they will serve.

Walgreens’ plans to open doctor offices is interesting, especially considering the convenience factor. This could streamline healthcare access for many, but it also begs the question of how these new clinics will handle patient volume. Perhaps a helpful tool for managing that could be the big shots get shots iphone app , designed to help organize appointments and track vaccinations.

Ultimately, the success of these new Walgreens clinics will depend on how well they integrate these types of tools and services to make the whole experience efficient and user-friendly.

Each model should balance the scope of services offered with the patient population it targets and the staffing requirements to effectively deliver those services. This includes analyzing the potential costs, revenue streams, and pricing strategies to achieve profitability. Furthermore, the integration of telehealth and digital tools will play a significant role in improving patient access and experience.

Scope of Services and Patient Population

The scope of services offered in Walgreens doctor offices will significantly impact the target patient population and staffing requirements. A comprehensive approach will involve careful consideration of the resources available and the financial sustainability of the model.

Model 1: Primary Care Focus

This model prioritizes primary care services for a broad range of patients. It aims to provide preventative care, diagnosis, and treatment for common illnesses. Patients seeking routine check-ups, vaccinations, and management of chronic conditions like diabetes or hypertension will be the target group.The staffing for this model will include primary care physicians, physician assistants, nurses, and administrative staff.

The estimated costs will include salaries, rent, equipment, and supplies. Revenue will come from patient fees for services, insurance reimbursements, and potential partnerships with health insurance companies. A possible pricing strategy could be tiered pricing based on insurance coverage.The advantages of this model include increased patient access to primary care, particularly in underserved areas. The disadvantages may include limited profitability due to the reliance on insurance reimbursements, which can fluctuate.

Telehealth integration can be crucial for appointment scheduling, remote monitoring, and follow-up care, improving patient convenience and potentially reducing overhead.

Model 2: Specialized Care

This model focuses on a specific area of healthcare, such as women’s health, or pediatrics. It will serve a more niche patient population with specialized needs. The staffing will be tailored to the specific area of care, with specialists, nurses, and potentially support staff.The costs will be higher due to the need for specialized equipment and potentially higher salaries for specialists.

Revenue streams will be primarily from patient fees, insurance reimbursements, and potential collaborations with specialists or healthcare organizations. Pricing strategies could be based on the complexity of the services rendered. Examples include specializing in women’s health services or pediatric care, both of which require specialized staff and resources.The advantages of this model include attracting a highly focused patient base and potential for higher revenue per patient.

So, Walgreens is opening doctor’s offices. It’s interesting to consider the broader implications, especially when considering the potential for increased access to healthcare. This raises a crucial question: should we save people who overdose drugs? The debate surrounding this complex issue is ongoing, and it’s important to consider the ethical and practical ramifications before any policies are implemented.

Ultimately, the opening of these doctor offices by Walgreens could potentially contribute to better healthcare access, but we need to examine the nuanced implications of such initiatives, including this crucial question of saving lives from drug overdoses. should we save people who overdose drugs. This is something we should all be discussing, to ensure that healthcare resources are used effectively and equitably.

The disadvantages could be the need for a larger investment in specialized equipment and higher staffing costs. Telehealth integration can be vital for offering consultations and follow-up care to patients.

Model 3: Urgent Care

This model prioritizes providing rapid access to care for acute illnesses and injuries. The patient population will include those seeking immediate medical attention for minor injuries, illnesses, or conditions requiring urgent care. The staffing requirements will consist of physician assistants, nurses, and medical assistants, along with administrative personnel.The estimated costs include facility expenses, equipment, staffing, and supplies. Revenue will primarily come from patient fees, insurance reimbursements, and potential partnerships with emergency services.

Pricing strategies could include tiered pricing based on the urgency and complexity of the case. A clear understanding of insurance coverage and reimbursement policies is essential for maximizing revenue.The advantages of this model include providing quick access to care for urgent situations. The disadvantages could be high overhead costs associated with staffing and operating an urgent care facility.

Telehealth can be integrated for triage and follow-up care, potentially reducing wait times and optimizing resource utilization.

Key Characteristics of Each Model

| Model | Services Offered | Target Patient Group | Staffing Requirements | Estimated Costs |

|---|---|---|---|---|

| Primary Care | Routine check-ups, vaccinations, chronic condition management | General population | Primary care physicians, physician assistants, nurses, administrative staff | Moderate |

| Specialized Care | Women’s health, pediatrics, etc. | Specific demographics | Specialists, nurses, support staff | High |

| Urgent Care | Minor injuries, illnesses, acute conditions | General population seeking immediate care | Physician assistants, nurses, medical assistants, administrative staff | Moderate |

Impact on Healthcare Access and Competition

Walgreens’ foray into the primary care market, with its planned doctor offices, promises to reshape the landscape of healthcare access, particularly in underserved communities. This expansion raises critical questions about the potential benefits and drawbacks for patients, existing healthcare providers, and the overall healthcare system. Will Walgreens’ presence truly improve access or exacerbate existing inequalities? Will it foster competition or lead to a consolidation of power?

The answers are not immediately clear, but a careful analysis of potential impacts is essential.

Impact on Access to Primary Care, Particularly in Underserved Areas

Walgreens’ strategy of establishing doctor offices in underserved communities could significantly increase access to primary care. This is especially true in areas lacking sufficient physician practices or where patients face significant transportation challenges. The convenience factor of having a Walgreens clinic close by could make a meaningful difference for these populations. However, it’s important to note that Walgreens’ model might not fully address the complex needs of vulnerable populations, such as those with limited insurance coverage or those who require specialized care.

It remains to be seen if the facilities and staffing will be sufficient to meet the unique healthcare needs of these communities.

Walgreens’ move to open doctor offices is definitely intriguing. It’s a smart play for a company looking to expand its healthcare offerings, and could potentially make accessing vital treatments like car t cancer treatment easier for many. Ultimately, though, the success of these new clinics will depend on factors like pricing and the quality of care they provide, which could significantly impact patient access to affordable medical services.

Potential Competitors and Reshaping the Primary Care Landscape

Walgreens faces significant competition in the primary care market, including established physician practices, hospitals, and other retail clinics. The introduction of Walgreens doctor offices will undoubtedly alter the competitive dynamics. This shift could lead to increased competition, potentially driving down prices and improving quality of care in some areas. However, the possibility of consolidation, particularly if Walgreens successfully integrates its doctor offices into its existing retail network, cannot be overlooked.

This could result in a less competitive landscape and reduced choice for patients. The overall effect on the primary care market hinges on the specific strategies Walgreens employs and the responses of existing competitors.

Impact on Existing Healthcare Providers

The entry of Walgreens into primary care will likely impact existing healthcare providers like hospitals and clinics. Hospitals might see a reduction in patients seeking basic primary care services if Walgreens clinics effectively attract this segment. On the other hand, Walgreens could partner with hospitals, potentially creating integrated care networks that offer comprehensive services. Clinics, both independent and those part of larger systems, could face pressure to adapt and innovate to maintain their market share.

The success of Walgreens’ strategy, therefore, will depend significantly on how effectively existing providers respond to the new competition.

Potential Impact on Insurance Coverage and Reimbursement Models

Insurance coverage and reimbursement models are crucial factors in the success of Walgreens’ doctor offices. If Walgreens can negotiate favorable contracts with insurers, it could offer competitive pricing for primary care services. However, if the reimbursement rates are lower than those of established providers, this could limit the accessibility of services for certain patients. The long-term impact on reimbursement models remains uncertain, but the potential for changes in pricing and payment structures is significant.

Table: Potential Impacts Across Different Stakeholders

| Provider Type | Positive Impacts | Negative Impacts |

|---|---|---|

| Walgreens | Increased market share, potential for new revenue streams, expanded reach into underserved areas. | Competition from existing providers, potential for lower reimbursement rates, challenges in attracting and retaining qualified medical professionals. |

| Hospitals | Potential for collaboration and integrated care models, reduced patient load for basic primary care. | Loss of primary care patients to Walgreens clinics, need to adapt to new competitive landscape. |

| Clinics (Independent & Chain) | Potential for specialization and focus on niche services, learning from Walgreens’ model. | Increased competition, pressure to reduce costs, potential loss of market share. |

| Patients | Increased access to primary care, potentially lower costs, greater convenience. | Potential for reduced quality of care, limited specialist options, unknown long-term outcomes. |

Potential Services and Patient Experiences

Walgreens’ expansion into doctor office services presents a unique opportunity to reshape the healthcare landscape. This expansion will directly impact patient experiences, accessibility, and the overall cost of care. Understanding the potential services, patient journey, and comparison to existing models is crucial to evaluating the success of this initiative.The integration of healthcare services into existing retail infrastructure promises a more convenient access point for routine care and urgent needs.

However, effectively addressing patient expectations and integrating this new model with traditional healthcare systems will be vital to long-term success.

Potential Medical Services

The comprehensive suite of services offered at Walgreens doctor offices will be a key differentiator. These offices will likely include preventive care, chronic disease management, and urgent care services, catering to a wide spectrum of patient needs.

- Preventive Care: This includes routine checkups, vaccinations, health screenings (blood pressure, cholesterol, diabetes), and health education. These services are crucial for early disease detection and promoting wellness. For example, Walgreens could offer flu shots, and well-child visits in their clinics.

- Chronic Disease Management: This encompasses managing conditions like diabetes, hypertension, and asthma. This may involve medication management, monitoring, and lifestyle counseling. A Walgreens clinic could partner with a registered dietitian to offer nutrition counseling to patients with chronic diseases.

- Urgent Care: This addresses minor illnesses and injuries that require prompt attention. Think sprains, cuts, colds, and fevers. The ability to treat common ailments quickly and efficiently is essential in a retail-based clinic setting. This could potentially reduce the strain on emergency rooms.

Patient Experience

The patient experience at Walgreens doctor offices will be a critical factor in their success. This encompasses everything from appointment scheduling to communication and wait times. Convenience and ease of access will be paramount.

- Appointment Scheduling: Online scheduling, readily available appointment slots, and potential same-day appointments will be crucial to meet patient demand and increase convenience. Examples of user-friendly online scheduling platforms can be observed in many modern healthcare systems.

- Wait Times: Streamlined processes and efficient staff management are essential to minimizing wait times. Utilizing technology to manage patient flow and prioritize urgent cases will be critical to patient satisfaction. This could involve queue management software and efficient staff deployment.

- Communication: Clear communication channels, including secure messaging platforms and online portals for appointment reminders and results, are essential. This is particularly important for patients with chronic conditions who need ongoing communication with their providers.

Impact on Specialist Access

Walgreens doctor offices will likely not be able to handle every type of specialty care. However, they could play a vital role in facilitating access to specialists.

- Referral System: Walgreens could establish a robust referral system to connect patients with specialists when necessary. This system should be seamless and easily accessible to patients.

- Collaboration with Specialists: Partnerships with local specialists could allow for seamless referrals and potentially reduce wait times for specialist appointments. This collaborative approach would be a valuable aspect of the expanded healthcare model.

Comparison to Traditional Clinics and Hospitals

The patient experience at Walgreens doctor offices will likely differ from traditional clinics and hospitals. Convenience and accessibility will be key advantages. However, patients may also perceive differences in the scope of services offered.

- Convenience: Walgreens’ location within a familiar retail environment will likely improve patient convenience. This aspect of convenience is a potential advantage over traditional clinics or hospitals located in less accessible areas.

- Accessibility: Walgreens’ extensive retail presence makes it easily accessible to a broader population. This contrasts with the limitations of traditional clinics and hospitals in terms of location and scheduling.

Potential Services, Wait Times, and Patient Satisfaction Metrics

| Service | Expected Wait Time (estimated) | Patient Satisfaction Metrics (example) |

|---|---|---|

| Routine Checkup | 15-30 minutes | 90% satisfied with appointment experience |

| Urgent Care (minor injuries/illnesses) | 30-60 minutes | 85% satisfied with speed of treatment |

| Chronic Disease Management | 30-45 minutes (initial visit) | 92% satisfied with care coordination |

Regulatory and Ethical Considerations

Walgreens’ expansion into doctor office services presents a complex interplay of regulatory hurdles and ethical considerations. Navigating these challenges is crucial for successful implementation and maintaining public trust. Careful attention to legal requirements and ethical principles will determine the long-term success and positive impact of this venture.

Regulatory Requirements for Opening Doctor Offices

Establishing a medical practice requires adherence to a multitude of regulations, often varying by state and locality. These regulations encompass licensing requirements for physicians, medical facilities, and potentially specific services offered. Obtaining appropriate licenses and permits is paramount to ensure legal operation and avoid potential penalties. Failure to comply with these regulations can result in severe consequences, including fines, license suspension, or even criminal charges.

- Physician Licensing: Each state has specific requirements for physician licensing, including educational qualifications, board certification, and ongoing continuing medical education (CME). Physicians must maintain their licenses to practice medicine legally. Walgreens will need to ensure all physicians employed or contracted meet these stringent requirements.

- Facility Licensing: Medical facilities require specific licenses and inspections to ensure compliance with health and safety standards. These standards cover aspects like infection control, equipment maintenance, and emergency preparedness. Walgreens will need to demonstrate the ability to meet these standards in the new facilities.

- Prescription Dispensing Regulations: While Walgreens is familiar with prescription dispensing, integrating it with doctor office services demands a thorough understanding of the specific regulations governing the dispensing of controlled substances and the secure handling of patient medication records. There are strict regulations on handling and storage of controlled substances.

Potential Licensing Challenges

Successfully navigating the licensing process is not always straightforward. Potential challenges include delays in obtaining permits, disagreements with regulatory bodies, and difficulties in meeting the required standards for both physicians and facilities. These challenges may be further exacerbated by the complexity of integrating new services into existing operations. Thorough due diligence and robust legal counsel are essential for minimizing these risks.

Ethical Dilemmas

Integrating healthcare services into a retail environment presents unique ethical considerations. Maintaining patient confidentiality and avoiding conflicts of interest are paramount. Ensuring physician autonomy and upholding professional standards is vital for patient well-being and trust.

- Conflicts of Interest: The potential for conflicts of interest arises from Walgreens’ dual role as a retailer and healthcare provider. Maintaining the objectivity and impartiality of medical advice, while also considering Walgreens’ business interests, is crucial. Transparency in these relationships is critical.

- Patient Confidentiality: Protecting patient confidentiality is paramount. Walgreens must implement robust security measures to safeguard sensitive patient information and comply with HIPAA regulations. Strict adherence to data privacy and security protocols is essential.

- Physician Autonomy: Physician autonomy in clinical decision-making must be respected. Any integration with Walgreens’ business operations should not compromise physician independence or the quality of care provided. Clear protocols are needed to balance the needs of the practice with the requirements of Walgreens.

Addressing Patient Safety and Quality of Care

To instill public trust, Walgreens must demonstrate a commitment to patient safety and quality of care. Clear protocols for patient intake, diagnosis, treatment, and follow-up must be established and regularly reviewed. Training programs for physicians and staff must emphasize patient-centered care.

- Quality Assurance Programs: Implementing rigorous quality assurance programs is crucial to ensure consistent standards of care. This may include regular audits of medical records, patient satisfaction surveys, and feedback mechanisms.

- Staff Training: Comprehensive training programs for all staff, including physicians, nurses, and administrative personnel, are essential to ensure they are equipped to handle patient needs appropriately and adhere to ethical guidelines.

Summary of Regulations and Ethical Considerations

| Category | Description |

|---|---|

| Regulatory Requirements | Includes physician licensing, facility licensing, prescription dispensing regulations, and adherence to health and safety standards. |

| Licensing Challenges | Potential delays, disagreements with regulatory bodies, and difficulty meeting standards. |

| Ethical Dilemmas | Conflicts of interest, patient confidentiality, and maintaining physician autonomy. |

| Patient Safety and Quality | Implementing quality assurance programs, staff training, and clear protocols for patient care. |

Public Perception and Community Impact

Walgreens’ foray into the healthcare sector through doctor office expansions sparks a mixed bag of public sentiment. Understanding the potential benefits and drawbacks is crucial for a successful implementation. This exploration dives into the nuances of public perception, community impacts, and the potential for enhanced healthcare access, while acknowledging the associated challenges.

Public Perception of Walgreens Doctor Offices

Public perception plays a pivotal role in the success of Walgreens’ expansion into healthcare. Positive perceptions can lead to increased patient trust and utilization of the services, while negative perceptions can hinder acceptance and adoption. Factors influencing public opinion include prior experiences with Walgreens, perceived quality of care, and overall trust in the healthcare provider. Past interactions with Walgreens, whether positive or negative, will undoubtedly shape initial public opinion about the new doctor offices.

Community Benefits of Walgreens Doctor Offices

Walgreens’ doctor offices can provide significant community benefits. Enhanced access to primary care is a key advantage, particularly in underserved areas. Increased competition in the healthcare market can potentially drive down costs and improve service quality. Lower barriers to entry, particularly for routine health needs, could lead to more accessible care for vulnerable populations.

- Improved Access to Care: Walgreens’ doctor offices can significantly improve access to primary care, especially in areas with limited healthcare options. This is particularly beneficial for individuals who face geographical barriers or financial constraints to accessing traditional healthcare services.

- Potentially Lower Costs: Increased competition in the healthcare market from Walgreens’ doctor offices could lead to more competitive pricing and potentially lower costs for routine medical services, improving affordability for patients.

- Expanded Service Offerings: Walgreens doctor offices could offer a wider range of services, including preventive care, vaccinations, and chronic disease management, potentially addressing the needs of a broader patient base.

Community Concerns Regarding Walgreens Doctor Offices

Concerns about the quality of care, staffing levels, and the overall impact on local healthcare providers are also likely to arise. The perceived quality of care, particularly concerning specialized care, may be a point of concern.

- Quality of Care Concerns: A primary concern centers around the quality of care provided in Walgreens doctor offices. Will the expertise of the staff be comparable to that of established healthcare providers? Patients may worry about the level of specialized care available.

- Staffing and Expertise: Ensuring adequate staffing with qualified and experienced physicians and other healthcare professionals is crucial for addressing potential concerns regarding the expertise available.

- Impact on Local Healthcare Providers: The expansion of Walgreens doctor offices could potentially impact local healthcare providers, leading to job displacement or reduced patient volume. This aspect needs careful consideration to mitigate any negative effects.

Potential Impact on Local Employment and Economic Development

The introduction of Walgreens doctor offices could have a mixed impact on local employment and economic development. While some job opportunities may be created, concerns about the potential displacement of local healthcare professionals exist. Careful planning and community engagement are needed to understand and mitigate these effects.

Illustration of a Community Gathering

Imagine a bustling town hall meeting room. Representatives from Walgreens, local healthcare providers, community leaders, and concerned residents are gathered around tables laden with information. Posters outlining the proposed Walgreens doctor office’s services and potential impact are prominently displayed. A Walgreens representative Artikels the office’s projected staffing and proposed partnerships with community organizations. Local physicians express their concerns about the potential impact on their practices, while community members voice concerns about the quality of care and potential job losses.

This scene vividly portrays the diverse perspectives and potential anxieties surrounding the expansion of Walgreens doctor offices.

Marketing and Branding Strategies

Walgreens’ expansion into the doctor office market necessitates a robust and targeted marketing strategy to establish brand recognition and trust among potential patients. This strategy must differentiate Walgreens’ offerings from existing healthcare providers and clearly articulate the unique value proposition. Crucially, the approach needs to be adaptable to various market segments and evolving patient preferences.A key element of this strategy will be the clear communication of the unique value proposition, positioning Walgreens doctor offices as accessible, convenient, and cost-effective alternatives to traditional healthcare facilities.

This involves highlighting the convenience of walk-in appointments, streamlined processes, and affordable pricing.

Brand Positioning and Differentiation

Walgreens must clearly define its brand identity in the healthcare sector. This means distinguishing itself from traditional medical practices and emphasizing its strengths as a pharmacy-based healthcare provider. The brand should communicate its commitment to patient care, accessibility, and affordability. This involves creating a distinct visual identity and messaging that resonate with the target audience. A key differentiator might be a focus on preventative care and wellness services, positioned as a complementary aspect to their existing pharmacy offerings.

Target Audience for Marketing Efforts

The target audience for Walgreens doctor offices will likely be comprised of several segments. These include individuals seeking convenient and affordable primary care, those who value the integrated nature of pharmacy and healthcare services, and those with limited access to traditional medical facilities. A specific focus on these groups will ensure that marketing efforts effectively reach the intended recipients.

Marketing Channels and Strategies

Understanding the diverse needs of potential patients is crucial for effectively reaching them. Targeting those in need of convenient access to healthcare, or who are interested in a holistic approach to their well-being, will be vital to the success of this initiative.

| Marketing Channel | Associated Strategies |

|---|---|

| Social Media (Facebook, Instagram, TikTok) | Creating engaging content showcasing the convenience and affordability of Walgreens doctor offices, highlighting testimonials from satisfied patients, and utilizing targeted advertising campaigns. |

| Search Engine Optimization () | Optimizing website content and online presence to rank higher in search engine results for relevant s like “primary care near me” and “affordable doctor.” |

| Partnerships with Local Businesses | Collaborating with local businesses to offer bundled services or promotional packages, reaching a wider audience and fostering community engagement. |

| Print Advertising (local newspapers, community magazines) | Using visually appealing advertisements to showcase Walgreens doctor office locations and services, focusing on local outreach. |

| Digital Advertising (Google Ads, social media ads) | Utilizing targeted online advertising to reach specific demographics and interests, optimizing campaigns based on performance data. |

Social Media and Digital Platforms

Walgreens should leverage social media and digital platforms to engage with potential patients. This involves creating informative and engaging content, hosting live Q&A sessions with doctors, and sharing success stories. Using video content on platforms like YouTube or TikTok can further demonstrate the ease of use and value proposition of Walgreens doctor offices. Visual demonstrations of services or behind-the-scenes glimpses into the offices can also be effective.

Differentiation from Competitors

Walgreens needs to highlight the value proposition that differentiates its doctor offices from other healthcare providers. This could include a focus on convenient scheduling, streamlined appointment processes, or the integrated nature of pharmacy and healthcare services. Emphasizing the cost-effectiveness of services, combined with high-quality care, will be crucial to attracting patients. Promoting a patient-centric approach, with a focus on ease of access and comprehensive care, will also help Walgreens stand out.

Last Point

In conclusion, Walgreens’ foray into primary care presents a compelling, albeit complex, proposition. While the potential benefits in terms of increased access and convenience are substantial, navigating the regulatory landscape, competing with established healthcare providers, and maintaining patient trust are significant hurdles. Ultimately, the success of Walgreens’ doctor offices will depend on its ability to deliver high-quality care, streamline patient experience, and effectively address community concerns.